Seamless recurring

payment management

directly on Salesforce

Set up, process, and reconcile large-volume recurring payments with ease.

Why FinDock for recurring payments?

Managing recurring payments shouldn’t be a headache. FinDock gives you full control over the entire payment lifecycle right inside Salesforce so you can deliver a frictionless experience for customers while ensuring predictable revenue. Whether you’re collecting subscriptions, donations, or membership fees, FinDock helps you achieve customer payment happiness by making payments work seamlessly within your Salesforce environment.

Built natively on Salesforce

Wide support of payment methods and processors

Automate reconciliation and reduce churn

Set up recurring payments

Streamline the entire recurring payment setup process.

Integrate into existing Salesforce solutions

FinDock integrates seamlessly into a wide range of Salesforce solutions, including Sales Cloud, Service Cloud, and Revenue Cloud, enhancing their subscription management capabilities. By leveraging Salesforce’s native capabilities, FinDock adds powerful features for setting up, managing, and reconciling recurring payments.

Support for multi-currency payments

FinDock works seamlessly with both single and multi-currency organizations, supporting any currency offered by payment service providers and direct debit schemes. This enables you to accept payments in multiple currencies

Support for multi-merchant setup

You can set up FinDock to process payments through multiple merchant and bank accounts across all major PSPs and FinDock’s direct debit native processing. This allows organizations to manage payments across divisions and departments for fine-tuned, independent business logic.

Support for localized direct debit schemes

FinDock supports localized direct debit schemes, including ACH, SEPA, Bacs, CH-DD, and LSV+, Autogiro and AvtaleGiro, enabling organizations to offer region-specific payment options while ensuring compliance with local banking standards. Find the full list of the supported direct debit schemes in our factsheet.

Set up recurring payments through any channel with our different solutions:

Online

PayLinks – Send payment links through channels like email, SMS, and QR codes, allowing customers to set up new recurring payments or update details such as card or bank account for existing recurring payments.

Giving Pages – Enable recurring donations with customizable forms on FinDock Giving Pages, allowing supporters to easily set up regular contributions while maintaining a consistent brand experience.

Payment API – Easily set up recurring payments using your preferred front-end forms or via Experience Cloud, allowing for a seamless integration into your existing website or app.

Phone or mail

Virtual terminal – Setup recurring payments over the phone directly in Salesforce with FinDock’s virtual terminal (MOTO).

Process recurring payments

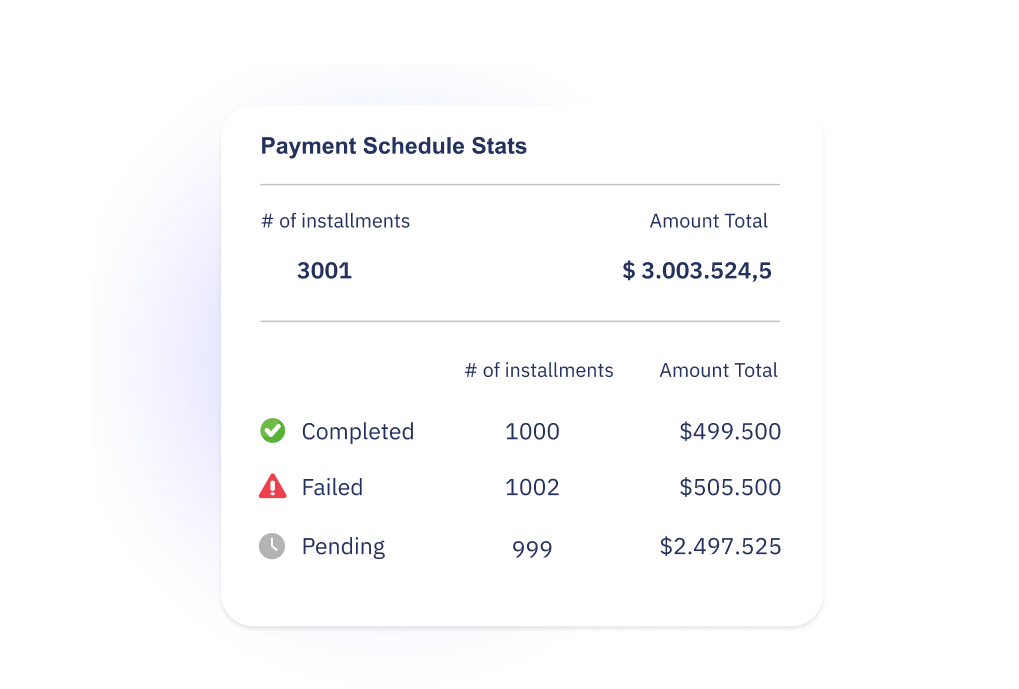

Fine-tuned control of collection through recurring payment schedules

The Recurring Payment Schedule allows you to easily create multiple payment schedules for a given period rather than creating each payment schedule individually. You can plan ahead your payment collection and use a single recurring payment schedule to cover, for instance the coming year. You can also automate payment schedules to auto-collect recurring payments over an unlimited period.

Support for a wide range of payment methods & processors

FinDock supports a wide range of international and local payment methods including cards, direct debit (SEPA, Bacs, ACH, etc.), digital wallets (Apple Pay, Google Pay), and local methods like iDEAL and Bancontact—just to name a few. Out-of-the-box, FinDock integrates with over 15 PSPs. Find the full list in our factsheet.

Manage your recurring payments via preferred Payment Service Provider

Manage Direct Debits through your own bank or bureau

Manage Direct Debit directly on Salesforce

Streamlined mandate registration and authorization

For direct debit schemes where mandates need to be registered and authorized before collecting payments, FinDock handles these steps through mandate schedules.

In some cases, the schedule results in a registration file that you send to a bank service or service bureau. In other cases, FinDock handles the registration details automatically with the bank service or PSP.

Streamline mandate management

For all natively supported direct debit methods, FinDock handles everything from mandate creation to registration, updating and cancelling, ensuring a seamless payment experience across various schemes including Autogiro, AvtaleGiro, and Bacs Direct Debit. Our integration with GoCardless offers a unified approach, optimizing your direct debit processes across all supported schemes. With FinDock, streamline how you manage mandates and enhance the security and efficiency of your payment collections.

Reconcile recurring payments

Match and enrich Salesforce data

With FinDock’s Guided Matching feature, incoming payment reports and notifications are automatically matched to the correct account on Salesforce, reducing manual effort and ensuring accuracy.

See payment statuses in real time

FinDock centralizes and reconciles all payment data in Salesforce, giving you a clear view of every payment status—paid, pending, or failed.

Retain customers and prevent churn

Prevent involuntary churn

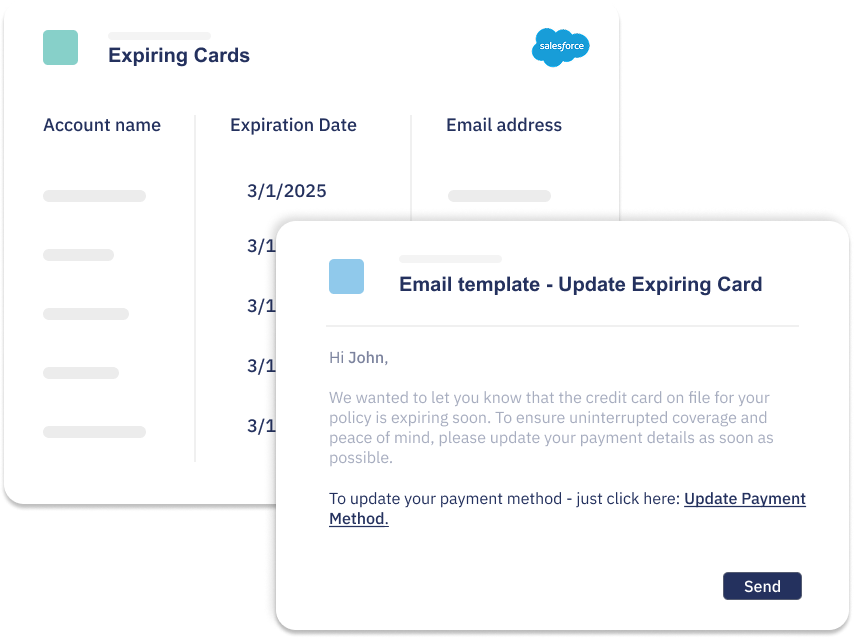

FinDock helps companies prevent failed payments by leveraging Salesforce data to trigger churn prevention journeys. With segmentation through Data Cloud, businesses can proactively engage customers, update payment details, and reduce involuntary churn.

Examples of use cases:

Prevent failed payments from expired cards

See it in action

Enable smooth transitions to new payment options

Some payment methods come with high transaction fees and manual reconciliation challenges. With FinDock, you can easily guide customers to switch to more cost-effective options, like direct debit, by sending a PayLink via email or SMS. In just a few clicks, they can update their payment details, reducing fees and ensuring seamless, automated contributions.

See it in action

Predict failed payments with Salesforce AI tools

FinDock, combined with Salesforce AI, enables organizations to predict and prevent failed payments using historical data. The right AI tool depends on your Salesforce license, so check with your admin to see what’s available for tackling payment failures.

We have covered some of them in detail:

Easily follow up on failed payments

With FinDock, you can follow up on failed recurring payments by triggering personalized emails, SMS, or other communications directly from Salesforce. By leveraging payment data and past engagement insights, you can determine the best channel to reach each customer—whether it’s email, SMS, or a call—based on their response history and payment behavior, increasing the chances of successful recovery.

Examples of use cases:

Following up with PayLinks

When a recurring payment fails, FinDock can automatically generate a PayLink—a secure, pre-filled payment link—and send it via email, SMS, or other channels. Since FinDock is Salesforce-native, you can use Salesforce Flow, Marketing Cloud, or other automation tools to trigger these follow-ups at the right time. Customers can easily update their payment details and complete the transaction in just a few clicks.